45% of Canadians Are Just $200 Away From Financial Trouble – Explore Your Options Today

Source: The Hub (2024). ‘The cost of living has led us into record debt: What does that mean for Canadians?’ Retrieved from thehub.ca

Family Halo offers free, nonprofit financial counselling to help you explore your financial options. Discover potential strategies to manage financial challenges and take the Financial Freedom Quiz to start your journey toward greater stability.

Tax Hot Potato?

Get Free Credit Counselling.

Family Halo, a nonprofit organization, offers free credit counselling to help you find trusted solutions that protect your financial future—without the hidden pitfalls of common government-promoted programs.

We proudly align with and uphold the standards of relevant professional associations and regulatory bodies—ensuring ethical, transparent service for you.

“Our biggest fear is ending up homeless.”

This gut-wrenching fear is real for thousands of Canadians like you. You’ve worked your whole life for your home—losing it feels unimaginable.

Source: The Hub (2024). ‘The cost of living has led us into record debt: What does that mean for Canadians?’ Retrieved from thehub.ca

*Instant Results | Secure & Confidential

An Urgent Message for Canadian Homeowners Struggling With 'Hot Potato Debt'

Dear Homeowner,

Feeling overwhelmed by debt and unsure of where to turn for support?

Does it seem impossible to regain financial stability without risking your home—or your family’s future?

Have you been told that bankruptcy or government programs are your only options for regaining financial stability?

The shocking reality?

Many government-approved programs claim to offer help but often leave Canadian homeowners worse off.

Why?

These programs are designed to prioritize creditors—not you.

At Family Halo, we believe Canadian homeowners deserve better. Government-backed programs often prioritize creditors over families, leaving many homeowners vulnerable to financial harm.

As consumer protection advocates, we believe in exposing the pitfalls of these traditional approaches and connect you with alternatives designed to protect your home, credit, and family’s future.

Here’s what many Canadians discover too late:

Government Programs Favor Banks: These programs often leave you vulnerable, prioritizing creditor profits over your financial recovery.

No Guarantee for Your Home: Your home isn’t protected, and you could still lose it—even while following their plans.

Long-Term Credit Damage: Your credit can take years to recover, making financial stability harder to achieve.

But there’s a better way. Family Halo is here to help.

Can you believe the "80%" ads?

We've all seen the ads...

Financial companies often make big promises of massive savings, but they frequently end up increasing your financial burdens while offering limited results.

The bottom line is this:

While some companies hook homeowners with “80% Savings” claims, these savings may come at the cost of damaging your credit score. Maintaining a strong credit score is vital for long-term financial health. This ensures you can access better mortgage rates or secure a home equity loan, avoiding higher repayment costs.

Be cautious of financial solutions that may expose your personal information to creditors or work against your best interests. Transparency and trust are key to making informed financial decisions.

Banks and financial institutions often prioritize their profits over your financial independence.

➞ Josh Balmer, founder of Strategic Credit Solutions and collaborator with Family Halo, recently shared his expert insights on debt settlement and Bill 55 in the respected Canadian Mortgage Professional Magazine (Click image to open article).

Improvements to Consumer Protection?

Think Again.

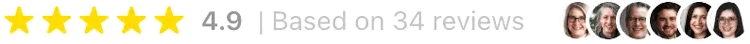

The Truth About Bill #55:

Marketed as consumer protection.

Reality?

A smokescreen.

Who really wins?

Banks. Trustees. Big business.

Their profits?

Based on your repayments, NOT your debt savings.

The incentives simply don’t align with homeowners' best interests.

And it's not even their fault...

The government sets the rules, and they must comply.

Here's what they don't want you to know:

Debt consultants advertise massive savings but often leave you owing more than when you started.

Loopholes still allow for unlicensed debt consultants who charge high fees.

Unlicensed companies can operate, with minimal oversight.

Severe penalties exist for debt advise, but consulting a debt advisor may also delay the debtor’s opportunity to seek the right solution for their financial challenges.

But There’s a Better Way

Imagine the freedom of living without financial stress, finally pursuing the dreams you’ve had to set aside.

Protect your most valuable asset—your home—while navigating through these challenging times.

Unforeseen circumstances happen, whether it's a job loss, medical emergency, or an unexpected crisis.

You're not alone in this. Thousands face similar financial challenges, and we're here to help you find a solution.

As a nonprofit, we provide impartial guidance to help you regain financial stability, focusing on your well-being and protecting what matters most.

Fight back against unfair practices that trapped you. We help you break free and regain control.

Reduce Your Financial Stress Quickly

Regain control of your finances and secure your future with confidence. Our compassionate approach helps you reduce financial stress while safeguarding what matters most. Take the first step toward financial independence today.

Preserve Your Credit Score

Unlike government programs that can harm your credit for years, our approach helps stabilize and rebuild your credit, putting you on the path to financial recovery sooner.

Protect What Matters Most

Preserve your home and maintain stability for your family, ensuring you avoid the heartbreak of unnecessary upheaval.

Achieve Real Progress in Months

Take decisive steps to tackle financial challenges—see tangible results in months, not years.

You deserve a financial plan that protects your home, your credit, and your family’s future. Let’s get started today.

INTRODUCING:

Family Halo Proprietary ‘Financial Freedom’ – The Ultimate Tool for Financial Clarity

Your Personalized Financial Freedom Plan: Gain Clarity in Minutes

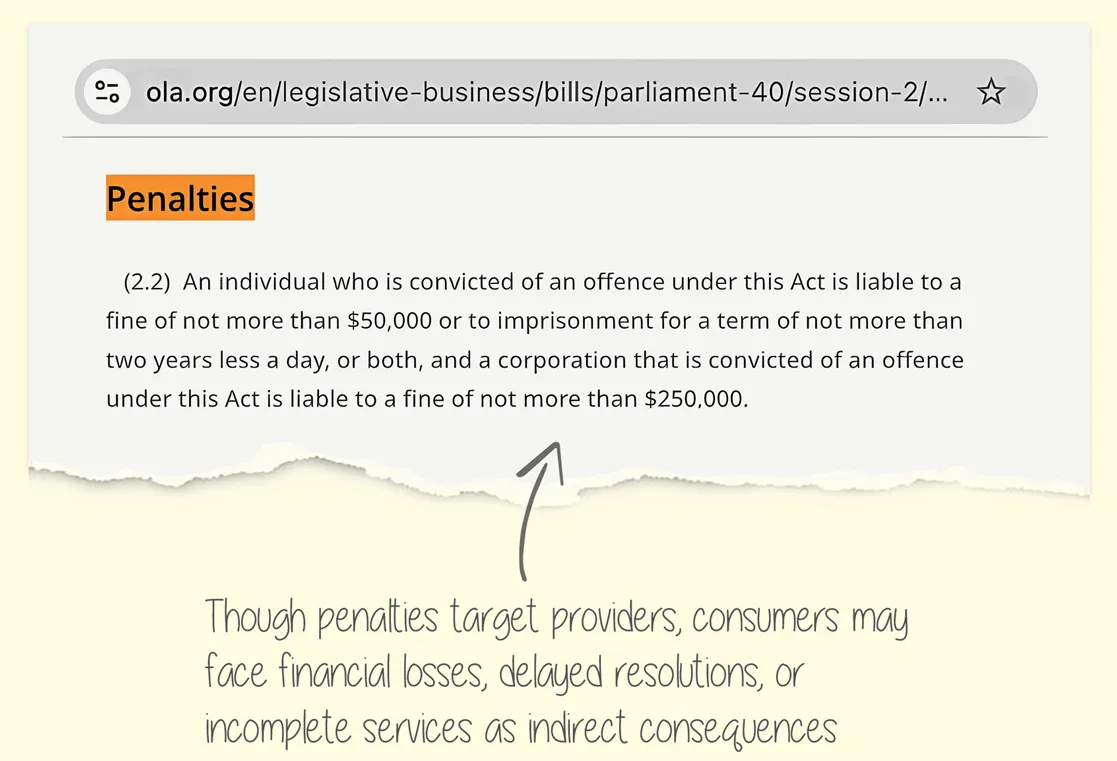

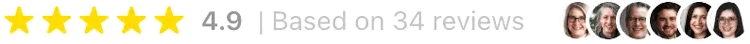

Overwhelmed by high-interest repayments? Our proven system identifies your Financial Freedom Number—the amount you can reduce—and provides your Freedom Date, marking the day your financial stress ends.

Take control in 3 simple steps:

1. Answer a few quick questions

2. Receive your freedom date & number

3. Get your personalized financial plan

Here’s what you’ll discover with the Financial Freedom Quiz:

Get your personalized Financial Freedom Number

Your Financial Freedom Number shows how much high-interest burden you can reduce with our specialized service.

Get Your Personalized Financial Freedom Date

Your Freedom Date provides a clear timeline for reducing high-interest payments, guiding you toward manageable, low-interest payments and lasting financial stability.

Get Your Personalized Financial Freedom Plan

Your tailored roadmap to securing your home and preserving your family’s lifestyle, ensuring stability for your children’s education and overall well-being.

*Get Personalized Report | Secure & Confidential

How We Helped Sylvia Save $26,180 And Secured Her Home Equity Loan

The Problem:

• Homeowner needed a second mortgage to consolidate to $48,281

• Loan-to-value ratio was too high for traditional lenders at 80.5%

• Risk of loan rejection due to exceeding the 80% LTV limit

How it turned out for Sylvia:

We connected the homeowner with our specialized debt education partners.

The Result:

Obligations reduced from $48,281 to $22,100

Total savings: $26,180

Loan-to-value ratio lowered to 74.8%

Home equity loan approved by institutional lender

Client's credit score started improving within 60 days

The Long-Term Impact:

By the end of the mortgage term, the lender had no issues renewing the mortgage. There was no "balloon payment" due as is often the case in consumer proposals for homeowners. Sylvia moved forward with significantly improved financial stability.

How It Works

Our partners assessed the homeowner's financial situation

Debt education experts worked out Sylvia's outstanding obligations

Reduced total obligations, restored and improved credit score and allowed a second equity loan to protect the future financial health of the family

Secured approval for the home equity loan

Set Sylvia on a path to improved financial health

John – Licensed Mortgage Broker and Part of Our Financial Advisory Team

A Team Committed to Your Financial Stability

At Family Halo, a certified nonprofit, our mission is to empower families globally with financial tools and education to achieve stability and long-term well-being.

Our team includes trained professionals from a variety of industries, such as mortgage brokerage and financial planning. Leaders like John Gallagher, a licensed Mortgage Broker under the Financial Services Regulatory Authority of Ontario (FSRAO), exemplify the dedication and expertise our team brings to supporting your unique journey.

For more about FSRAO, visit fsrao.ca

Call John during business hours: +1 (905) 541-2504

Family Halo collaborates with Cirrius Finance Corp (#10254) to extend its services. Please note, the Law Society of Ontario is an independent membership of lawyers without governmental authority in financial matters.

How We Saved $26,180 for Sylvia And Secured Her Second Mortgage

The Problem:

• Homeowner needed a second mortgage to consolidate $48,281 in debt

• Loan-to-value ratio was too high for traditional lenders at 80.5%

• Risk of loan rejection due to exceeding the 80% LTV limit

Our Solution:

We connected the homeowner with our specialized debt settlement partners.

The Result:

Obligations reduced from $48,281 to $22,100

Total savings: $26,180

Loan-to-value ratio lowered to 74.8%

Second mortgage approved by institutional lender

Client's credit score started improving within 30 days

The Long-Term Impact:

By the end of the mortgage term, the lender had no issues renewing the mortgage. There were no new onerous loans to pay like consumer proposals often have. Sylvia moved forward with significantly improved financial stability.

How It Works

We assessed the homeowner's financial situation

Identified the loan-to-value ratio obstacle

Partnered with debt education experts to negotiate outstanding payments

Obligations reduced from $48,281 to $22,100

Secured approval for the

home equity loan

Set the client on a path to improved financial health

John – Licensed Mortgage Broker and Part of Our Financial Advisory Team

A Team Committed to Your Financial Stability

At Family Halo, a certified nonprofit, our mission is to empower families globally with financial tools and education to achieve stability and long-term well-being.

Our team includes trained professionals from a variety of industries, such as mortgage brokerage and financial planning. Leaders like John Gallagher, a licensed Mortgage Broker under the Financial Services Regulatory Authority of Ontario (FSRAO), exemplify the dedication and expertise our team brings to supporting your unique journey.

For more about FSRAO, visit

fsrao.ca

Call John during business hours: +1 (905) 541-2504

Family Halo collaborates with Cirrius Finance Corp (#10254) to extend its services. Please note, the Law Society of Ontario is an independent membership of lawyers without governmental authority in financial matters.

Options Comparison Table

| Option | FEA System | Consumer Proposal |

|---|---|---|

| Credit Rating | Restored in 6-9 months |

Affected for up to 7 years |

| Home | Keep your home | Risk of losing home & assets |

| Financial Options | Reduce for less than owed | Repay 130% of your obligations interest-free |

| Impact on Family | No disruption to their lives | Risk of moving or losing stability |

Simulate Your Savings

Demonstration Purposes Only

: Calculator provides estimates based on a typical scenario of a $600,000 mortgage with $50,000–$200,000 in unsecured obligations. Please exclude mortgages or car loans from this calculation. This is not financial advice—individual outcomes will vary. Consult a licensed professional for tailored guidance.

← What is your current outstanding financial obligation (excluding your mortgage)? →

Fractional Equity

Allocation (FEA) System

Consumer Proposal

Debt Repayment

Get Your Personalized Financial Freedom Number Now!

Discover Your Path to Financial Freedom in 3 Simple Steps – Starting with Our Free Financial Freedom Quiz

STEP 1

Take the Financial Freedom Quiz

Get a quick assessment of your financial situation. Discover your preliminary Financial Freedom Number and Freedom Date.

* NO SIGN-UP REQUIRED

STEP 2

Book Your Personalized Financial Strategy Call

Meet with a Family Halo financial expert for free, who will review your results and discuss tailored strategies to achieve your goals.

STEP 3

Get Your Personalized Financial Plan

Complete your financial dossier with a trusted expert we recommend to guide you on your path to financial stability.

Ready to get started?

Sylvia D.

They saved our family, our house, our future and our credit.

Maria P.

Despite endless overtime hours we were drowning in repayments and stress. Their expert guidance provided the informal settlement solutions we desperately needed. Thanks to them, we've reduced our obligations, protected our credit score, and can finally sleep knowing our home is safe.

Who We Help

Homeowners Facing Financial Pressure

Family Halo guides Canadian homeowners toward financial stability with solutions that protect their homes and credit.

We help you to:

• Discover your personalized Financial Plan and create a pathway to a brighter financial future.

• Protect your home and avoid disruptions to your family’s stability.

• Regain control while safeguarding your credit score.

Get a tailored strategy designed to address your unique challenges, keeping your home and credit intact with confidence and ease.

5 Reasons Family Halo’s Approach Works for Homeowners

Tailored Solutions: We evaluate your unique situation to craft a plan that fits your goals and priorities.

Protects What Matters: Safeguard your home and avoid financial instability caused by risky decisions.

No Long-Term Damage: Avoid traps like bankruptcy or consumer proposals that harm your credit and future.

Expert Advisors: Work with a compassionate team that understands your needs and delivers fast, reliable advice.

Peace of Mind: Start living stress-free, knowing you’ve chosen a proven path to financial recovery.

Strategies Tailored for You, Not the Banks

The Growing Financial Pressure

Canada’s Financial Crisis Is Pushing Homeowners to the Edge

With Canadian household costs skyrocketing, more families are struggling to make ends meet. Unlike other countries, homeowners here face limited options, leaving many vulnerable to financial collapse without clear solutions.

The Flawed “Solutions” You’ve Been Told About

Why Government-Backed Programs Often Fall Short

Consumer proposals and other government-endorsed options are often designed to prioritize creditors, not families. These programs come with:

High interest rates post rating demise and strict financial disclosure requirements.

No guarantee your home is protected from creditors.

Long-term financial setbacks that are difficult to recover from.

A New Way Forward

Speak with a Family Halo counselor today in complete privacy and confidentiality to receive guidance on how to stop calls from collection agencies and achieve a brighter financial future.

Protect your home and family’s stability.

Strengthen your financial standing without damaging your credit.

Help you regain control, without the pitfalls of traditional programs.

TAKE THE QUIZ TODAY

Imagine living without the constant stress of high-interest repayments

Protect what matters most—your home and family’s future.

With expert guidance from Family Halo, you’ll learn how to preserve your credit, secure your home, and achieve lasting financial peace of mind.

Today: Start Your Journey

- Approx. Home value

- Current mortgage balance

- Outstanding financial obligations

Within Days: Speak with an Advisor

30–45 Days: Create Your Action Plan

Relief Day: Your Journey Forward

Secure & Confidential

We’ve connected hundreds of Canadian homeowners with trusted financial experts, helping them find alternative solutions the government doesn’t talk about—protecting over $50 million in homes, savings, and futures.

We've got your back.

Protect your home and reduce financial stress without a consumer proposal. Our 3-step system helps you negotiate with creditors and safeguard assets.

Take control today.

Prefer to speak with someone directly?

Get a FREE 20-minute call with a Family Halo financial advisor to explore the best options available for your situation. Learn how to take control and move toward financial stability with personalized guidance.

Free assistance available during business hours.

Protect your home and reduce financial stress without a consumer proposal. Our 3-step system helps you negotiate with creditors and safeguard assets.

Take control today.

Got Questions?

"What makes our advice different from the other financial counselling?"

Seeking guidance from a non-profit financial counselor offers a balanced and impartial approach to achieving long-term financial health. Non-profit counselors are dedicated to helping you improve your financial well-being without being tied to selling specific products or services. This ensures that the advice you receive is tailored to support your financial recovery, with fees often structured to reflect the value of the assistance provided. Reach out to organizations that prioritize your financial stability and success.

"Will I lose my home?"

Our system connects you with a financial partner who will work with you to explore available options. Depending on your situation, they may be able to assist in finding solutions to help you maintain homeownership.

How much can I reduce what I owe?

Many homeowners discover that they may be able to address their financial challenges for less than their original obligations. During your free consultation, Family Halo advisors will review your situation and connect you with trusted experts to explore potential solutions for managing your financial situation effectively.

"How long does it take to restore my credit?"

Unlike bankruptcy, which can impact your credit for several years, many individuals may see improvements in their credit within 6 to 9 months, depending on their unique financial situation.

"I'm worried this might not really work for us."

It’s completely natural to feel uncertain—many families we’ve worked with have felt the same way. However, taking the first step to explore your options can provide clarity and potential solutions. If you have equity in your home, there may be alternatives worth considering that align with your long-term financial goals.

We’ve helped connect countless Canadian families with trusted experts who have guided them in exploring options to maintain homeownership and achieve financial stability. You don’t have to navigate this alone, and there’s no pressure—just an opportunity to see what solutions may be available to you

"What if there are hidden costs or it’s just another scam?"

We completely understand this concern—when you’re already feeling vulnerable, trust is essential. That’s why Family Halo prioritizes transparency and honesty in every step of the process.

As a nonprofit, we’re here to connect you with trusted experts who provide clear terms with no hidden fees. You’ll always have a clear understanding of your options, and any associated costs will be disclosed upfront.

What is the Financial Freedom Quiz?

The Financial Freedom Quiz is a quick, 2-minute assessment designed to gather key details about your financial situation, including your home’s value, mortgage balance, and other relevant factors.

Based on your answers, we’ll provide personalized insights and recommendations to help you explore potential solutions for greater financial stability. Think of it as your starting point for understanding the options available to safeguard your home, credit, and overall peace of mind.

How will the personalized report help me?

The custom report is designed to provide you with clear, actionable insights tailored to your financial situation. It includes:

• A breakdown of potential options to help manage financial strain.

• Guidance on strategies for maintaining homeownership and protecting your credit.

• A step-by-step overview of how to explore expert-backed solutions suited to your unique needs.

This report serves as your personalized roadmap, helping you better understand your situation and make informed decisions toward greater financial stability.

What happens if I’m not satisfied?

Family Halo is a free service dedicated to helping you explore the right financial solutions. While we don’t charge any fees, we are committed to connecting you with trusted professionals.

The experts in our network have assisted countless Canadian families in navigating their financial options, preserving homeownership, and working toward greater financial stability. Your success is our priority, and we’re here to support you every step of the way.

Here’s What You’ll Get with the FEA System by taking the Debt Compass Quiz

Protect your home and reduce financial stress without a consumer proposal. Our 3-step system helps you negotiate with creditors and safeguard assets.

Take control today.

➜ Real debt reduction without risking your home equity.

➜ Pay Less—fees from debt savings, not repayments.

➜ Expert negotiation with creditors to reduce your debt.

➜ Personalized debt strategy tailored to your situation.

Unlock Your ‘Financial Freedom Number’ with Our Free 2-Minute Financial Freedom Quiz

Find out how much your financial obligations could be reduced by and get your Freedom Date—the day you can start rebuilding your life.

FAMILY HALO

FINANCIAL EDUCATION FOR REGULAR FAMILIES

+1 (904) 815-0735

©2023 Family Halo All rights reserved.

Family Halo is a 1901 French Association

RNA: W92202103

42 rue Jeanne Gleuzer, 92700 Colombes, France

Need financial guidance? Our caring Family Halo coaches offer free 20-minute consultations . Let's work together to create a personalized plan for your financial well-being and a brighter future.

Prefer to just speak with an guidance expert now?

Looking for financial guidance? Our compassionate Family Halo coaches offer free 20-minute consultations to help you explore your options. Together, we can outline a personalized approach to support your financial well-being and work toward a more secure future.

Google Ads Disclaimer:

Results are not guaranteed and may vary for each individual. The information provided on this site is for general informational purposes only and should not be considered a substitute for professional financial, legal, or other expert advice.

Family Halo does not make any representations or warranties regarding the accuracy, completeness, or reliability of the information available on this website, and such information is subject to change without notice. You are encouraged to verify any information obtained from this site with qualified professionals or other reliable sources.

Family Halo does not recommend, endorse, or make any representations about the effectiveness, appropriateness, or suitability of any information, services, or sponsor-provided content that may be accessible through this website.